Corporate Governance

- Sustainability Initiatives and Policy

- Environmental Initiatives

- Social Contribution Initiatives

- Corporate Governance

- Green Financing

- Sustainability-related Disclosure

Measures taken for the purpose of aligning the interests of ADL's unitholders and the ITOCHU Group

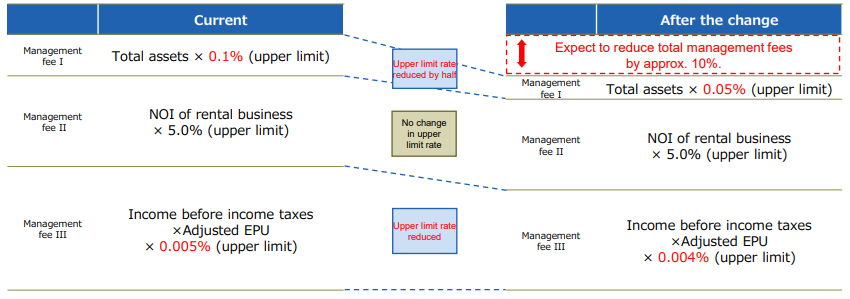

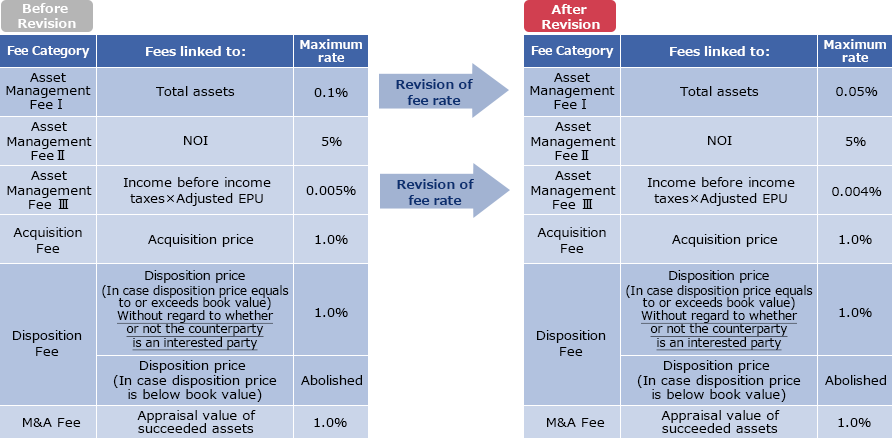

(1) Further change to a management fee structure linked to unitholders' profit

In order to adopt a compensation structure that is even more closely linked to unitholders' profits, the Investment Corporation resolved at its general meeting of unitholders held in April 2022 to change its management compensation structure as follows, effective August 1, 2022. By adopting the following management remuneration system, we aim to further align the interests of the Investment Corporation's unitholders with those of the Asset Manager.

(2) Same-boat investment in ADL by ITOCHU Corporation

ITOCHU Corporation, ADL's sponsor, holds a certain number of ADL's investment units. Such investment by the sponsor in ADL's investment units would align the sponsor's interests with ADL's unitholders and is therefore expected to encourage strong sponsor support for mid- to long-term growth of ADL.

(3) Investment in ADL's investment units by Directors and Employees of Asset Management Company (Employee Investment Unit Ownership Program / Cumulative Investment Unit Investment Program for Full-time Directors)

IRM has Employee Investment Unit Ownership Program in place, with the goal of aligning the interests of its employees with ADL's unitholders. IRM's full-time directors also invest in ADL's investment units through a cumulative investment unit investment program.

ITOCHU REIT Management CO.,LTD., the asset management company, is taking the following measures to address governance.

ITOCHU Corporation

ITOCHU Corporation